In the journey towards homeownership, understanding mortgage qualifications is crucial. Recent research conducted by Fannie Mae sheds light on the significance of mortgage education in dispelling myths and equipping individuals with the knowledge needed to make informed decisions.1

Dispelling Misconceptions

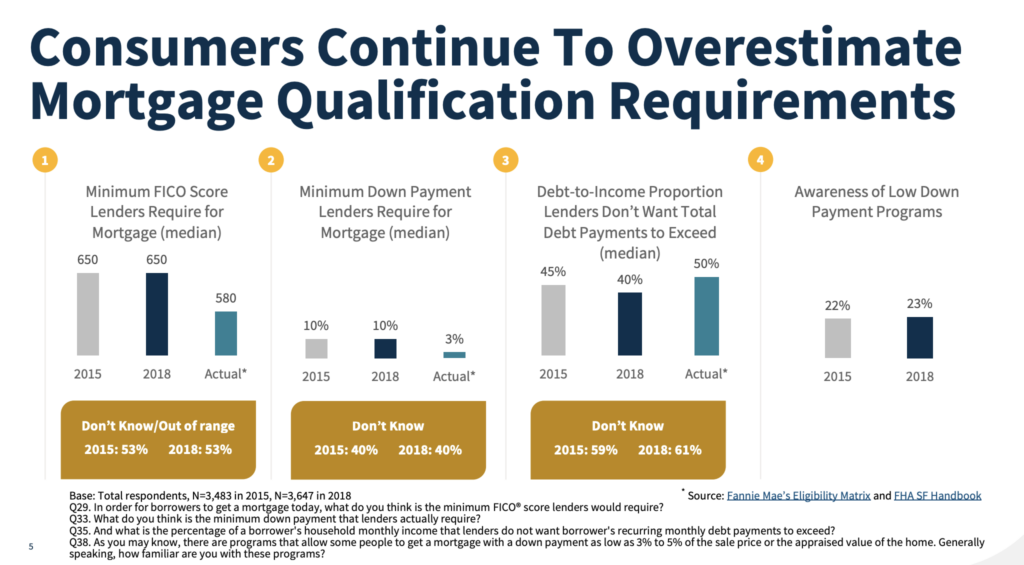

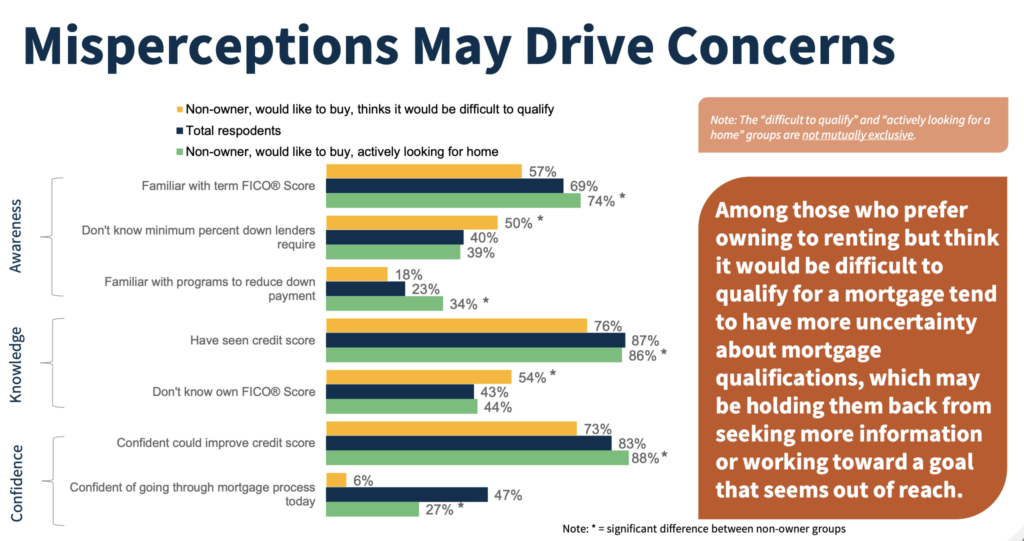

The Fannie Mae study reveals widespread misunderstandings among consumers regarding mortgage qualifications, particularly concerning credit scores and down payments. However, through education, individuals can gain clarity on the true requirements for mortgage approval, enabling them to navigate the process with confidence.

Navigating with Confidence

Armed with mortgage education, individuals can navigate the complexities of the mortgage landscape more effectively. From the initial application to closing, they have the knowledge and tools to make informed decisions at every step of the journey. This empowers them to pursue homeownership with confidence and clarity.

Recommendations

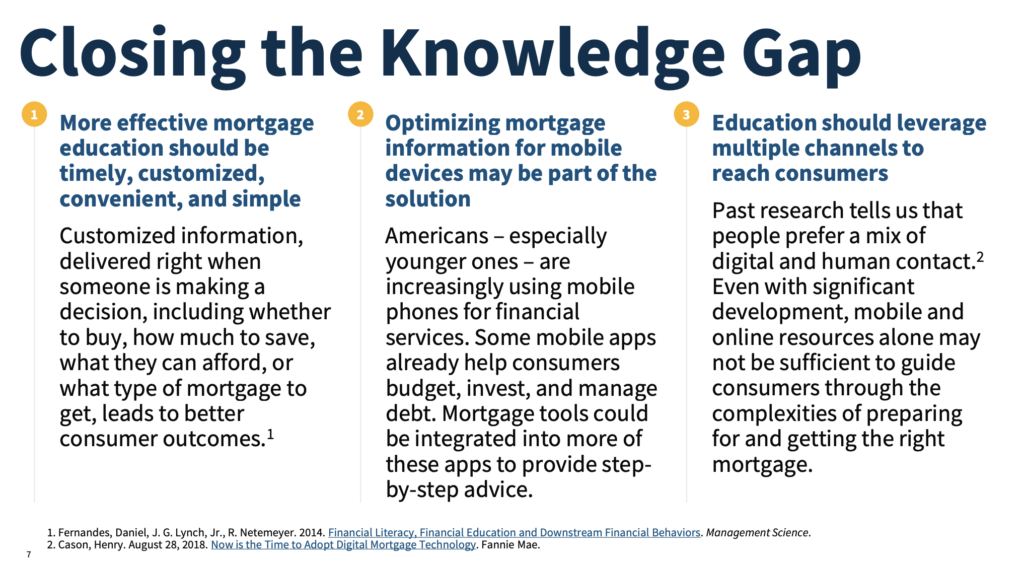

Closing the knowledge gap surrounding mortgage qualifications is essential for promoting homeownership and financial empowerment. The study highlights three recommendations for empowering consumers with information. Through customized timely education, mobile friendly content, and multi-channel communication approaches we can help individuals overcome misconceptions and make informed decisions about their housing options, ultimately paving the way for a more inclusive and accessible housing market.

Conclusion

By dispelling myths, fostering financial literacy, and instilling confidence, mortgage education can become a powerful tool in empowering individuals to achieve their homeownership goals

Source:

- Fannie Mae. “National Housing Survey: Q3 2023 Data Release”. Accessed on Fannie Mae’s website. ↩︎